Unlocking Success with Our **Profit Margin Calculator**

Master your business’s financial health by understanding profit margins and leveraging our powerful **Profit Margin Calculator** for optimal pricing and growth.

What is Profit Margin?

**Profit margin** is a critical financial metric used to assess the profitability of a business, a product, or a service. Essentially, it represents the percentage of revenue that remains after deducting costs. It’s expressed as a percentage, indicating how many cents of profit a business has generated for each dollar of revenue. A higher profit margin suggests a more efficient and financially healthy business.

There are generally three main types of profit margins:

- **Gross Profit Margin:** This measures the profitability of a company’s core operations after accounting for the cost of goods sold (COGS). It’s calculated as $(Revenue – COGS) / Revenue \times 100\%$. It tells you how much profit a company makes from its sales after covering the direct costs of producing its goods or services.

- **Operating Profit Margin:** This indicates the percentage of revenue left after deducting COGS and operating expenses (like salaries, rent, utilities, marketing). It’s calculated as $(Revenue – COGS – Operating\ Expenses) / Revenue \times 100\%$. This margin shows how efficient a company’s management is at controlling costs associated with its ordinary business activities.

- **Net Profit Margin:** This is the ultimate measure of profitability, showing the percentage of revenue left after *all* expenses, including COGS, operating expenses, interest, and taxes, have been deducted. It’s calculated as $(Net\ Income) / Revenue \times 100\%$. This figure represents the actual profit available to shareholders or for reinvestment in the business.

Understanding and tracking these different profit margins is vital for making informed business decisions, from pricing strategies to cost control and overall financial planning.

Why Use a **Profit Margin Calculator**?

In the dynamic world of business, knowing your numbers isn’t just important; it’s essential for survival and growth. A **Profit Margin Calculator** is an indispensable tool that offers numerous advantages for businesses of all sizes:

- **Instant Accuracy:** Manually calculating profit margins, especially across multiple products or services, is prone to errors and time-consuming. A calculator provides instant, precise figures, eliminating the risk of costly mistakes in pricing and financial analysis.

- **Informed Pricing Strategies:** Quickly determine how changes in cost or selling price impact your profitability. This allows you to set competitive yet profitable prices, optimize discounts, and react swiftly to market changes without guessing.

- **Enhanced Business Insight:** Gain immediate clarity into the financial viability of individual products, service lines, or your entire business. Identify which offerings are most profitable and which might be underperforming, guiding your strategic decisions.

- **Cost Control and Optimization:** By seeing the direct impact of costs on your margins, you can pinpoint areas where expenses might be too high. This helps in negotiating better supplier deals, optimizing production processes, or reducing overheads.

- **Goal Setting and Performance Monitoring:** Easily set realistic profit targets and track your performance against these goals. Regular use of a calculator helps you stay on course with your financial objectives.

- **Improved Decision-Making:** Whether it’s evaluating a new product launch, assessing a marketing campaign’s effectiveness, or making investment decisions, accurate profit margin data empowers you to make smarter, data-driven choices.

- **Competitive Analysis:** Understand your margins relative to industry benchmarks. This insight can reveal if your pricing or cost structure is out of sync with competitors, allowing for adjustments to maintain market position.

- **Simplifies Financial Planning:** For budgeting, forecasting, and long-term financial planning, having readily available and accurate profit margin data is invaluable. It forms the basis for sustainable growth strategies.

- **User-Friendly Accessibility:** Online **Profit Margin Calculators** are typically easy to use, requiring no specialized accounting software or expertise. They provide quick answers whenever you need them, from any device with internet access.

By integrating a **Profit Margin Calculator** into your financial toolkit, you move from guesswork to precise, actionable insights, driving greater profitability and sustainable business success.

Benefits of Understanding Your Profit Margin

Beyond the simple calculation, a deep understanding of your profit margins offers profound benefits that can significantly impact your business’s health and trajectory:

- **Strategic Pricing Decisions:** Knowing your exact profit margin allows you to set prices that cover all costs and ensure desired profitability. You can strategically adjust prices for different products/services, offer discounts, or run promotions without unintentionally eroding your earnings.

- **Efficient Cost Management:** Profit margin analysis highlights the relationship between your revenue and various costs. If margins are low, it prompts you to investigate and identify areas for cost reduction, such as optimizing procurement, improving operational efficiency, or renegotiating supplier contracts.

- **Product/Service Prioritization:** By comparing margins across different offerings, you can identify your most profitable products or services. This insight enables you to allocate resources more effectively, focusing marketing efforts and investments on areas that generate the highest returns.

- **Performance Evaluation:** Profit margins serve as a key performance indicator (KPI). Monitoring them over time helps assess your business’s financial health, identify trends, and evaluate the effectiveness of strategic initiatives or changes in operations.

- **Investment and Growth Planning:** Healthy profit margins signal that your business is generating sufficient cash flow for reinvestment, expansion, or attracting investors. It provides confidence to pursue growth opportunities.

- **Cash Flow Forecasting:** Understanding how much profit each sale generates contributes to more accurate cash flow forecasts, helping you manage liquidity and anticipate future financial needs.

- **Benchmarking Against Competitors:** Comparing your profit margins to industry averages or competitors provides valuable context. If your margins are lower, it suggests you might need to improve efficiency or adjust pricing. If they’re higher, it indicates a strong competitive advantage.

- **Risk Assessment:** Declining profit margins can be an early warning sign of impending financial difficulties, such as increased competition, rising costs, or decreased demand. Early detection allows for proactive adjustments.

- **Improved Stakeholder Confidence:** Demonstrating a solid understanding and healthy management of profit margins instills confidence in investors, lenders, and other stakeholders, making your business more attractive for funding and partnerships.

In essence, profit margin isn’t just a number; it’s a narrative of your business’s efficiency, competitiveness, and potential for sustained success. Leveraging a **Profit Margin Calculator** helps you write that narrative with precision and foresight.

Key Formulas Used in a **Profit Margin Calculator**

A comprehensive **Profit Margin Calculator** relies on fundamental financial formulas to provide accurate insights. Understanding these calculations helps you interpret the results and grasp the underlying financial health of your business:

- **Revenue (Sales):** This is the total amount of money generated from the sale of goods or services before any expenses are deducted. *Formula:* `Revenue = Selling Price per Unit × Quantity Sold` (for products) or `Revenue = Rate × Hours/Units` (for services).

- **Cost of Goods Sold (COGS):** These are the direct costs attributable to the production of the goods sold by a company or the services provided. *Formula:* `COGS = Beginning Inventory + Purchases – Ending Inventory` (for goods) or `COGS = Direct Material Cost + Direct Labor Cost` (for services where applicable).

- **Gross Profit:** This is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services. *Formula:* `Gross Profit = Revenue – COGS`

- **Gross Profit Margin (%):** This is the percentage of revenue that translates into gross profit. It shows the efficiency of production or service delivery. *Formula:* `Gross Profit Margin = (Gross Profit / Revenue) × 100%`

- **Operating Expenses:** These are the costs incurred by a business in its normal operations, not directly tied to production. Examples include salaries, rent, utilities, marketing, and administrative costs.

- **Operating Profit (EBIT – Earnings Before Interest and Taxes):** This represents the profit a company makes from its core business operations, before accounting for interest and taxes. *Formula:* `Operating Profit = Gross Profit – Operating Expenses`

- **Operating Profit Margin (%):** This indicates the percentage of revenue that remains after operating expenses are accounted for. It’s a measure of operational efficiency. *Formula:* `Operating Profit Margin = (Operating Profit / Revenue) × 100%`

- **Net Income (Net Profit):** This is the “bottom line” profit, representing the total earnings after all expenses, including interest and taxes, have been deducted from revenue. *Formula:* `Net Income = Operating Profit – Interest Expenses – Taxes`

- **Net Profit Margin (%):** This is the most comprehensive measure of profitability, showing the percentage of revenue left after all costs are considered. *Formula:* `Net Profit Margin = (Net Income / Revenue) × 100%`

A good **Profit Margin Calculator** will allow you to input your raw financial data and instantly compute these critical percentages, providing a clear snapshot of your financial performance.

Who Should Use a **Profit Margin Calculator**?

A **Profit Margin Calculator** is an invaluable tool for a wide range of individuals and businesses, regardless of their size or industry. Anyone keen on understanding and improving their financial performance stands to benefit:

- **Business Owners:** From sole proprietors to SMB owners, this tool is essential for understanding the profitability of their entire operation and individual products/services.

- **Entrepreneurs & Startups:** Crucial for validating business models, setting initial pricing, and ensuring viability before launching a product or service.

- **Financial Managers & Accountants:** Used for detailed financial analysis, reporting, budgeting, and strategic planning.

- **Sales Managers:** Helps in understanding pricing flexibility, setting sales targets, and evaluating the profitability of different deals or customer segments.

- **Product Managers:** Essential for determining the profitability of new products, optimizing existing product lines, and making build-or-buy decisions.

- **Marketing Professionals:** Enables the assessment of campaign ROI by linking marketing spend to revenue and subsequent profit.

- **Investors:** Used to analyze a company’s financial health and efficiency before making investment decisions.

- **Freelancers & Consultants:** Vital for setting hourly rates or project fees that ensure adequate personal income after considering all business expenses.

- **E-commerce Sellers:** Helps optimize pricing for online products, factoring in platform fees, shipping costs, and advertising spend to ensure healthy margins.

- **Anyone with Revenue and Costs:** Fundamentally, if you generate revenue and incur costs, calculating your profit margin will provide crucial insights into your financial efficiency.

In essence, if you want to move beyond just tracking sales to truly understanding how much money your business is *actually* making, a **Profit Margin Calculator** is a necessary and powerful ally.

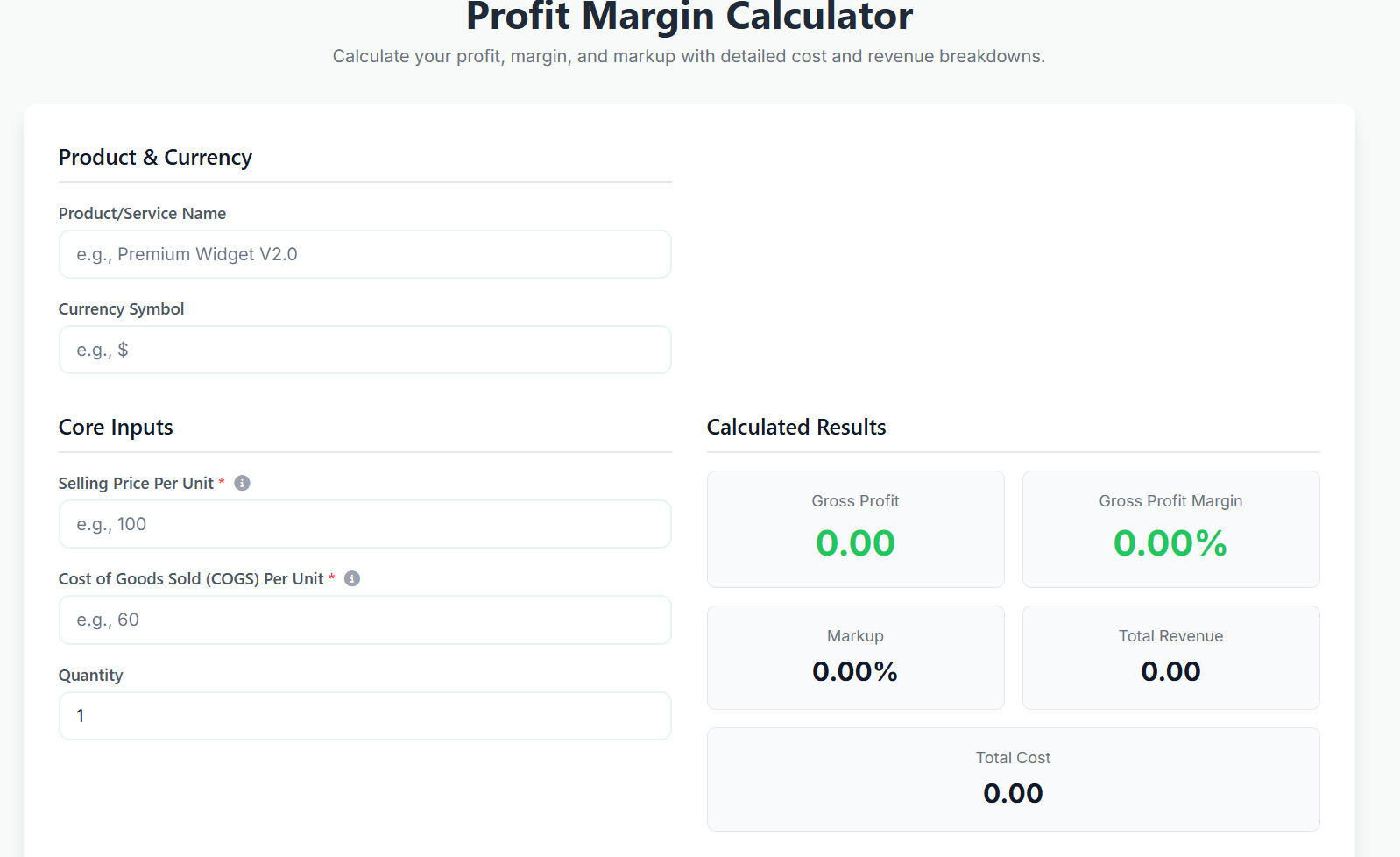

How to Use Our Free **Profit Margin Calculator**

Our online **Profit Margin Calculator** is designed for simplicity and accuracy, allowing you to quickly determine your profitability without complex spreadsheets or accounting software. Here’s how to use it step-by-step:

- **Identify Your Revenue:** Begin by inputting your total **Revenue** (also known as Sales Revenue or Total Sales). This is the total amount of money you generated from selling your products or services. Enter this figure into the designated “Revenue” field.

- **Determine Your Cost of Goods Sold (COGS):** Next, input the **Cost of Goods Sold (COGS)**. This includes all direct costs associated with producing the goods or services you sold, such as raw materials, direct labor, and manufacturing overhead. Enter this into the “Cost of Goods Sold (COGS)” field.

- **Add Your Operating Expenses:** If you want to calculate your Operating Profit Margin, enter your **Operating Expenses**. These are indirect costs of running your business, not directly tied to production. Examples include salaries (non-production staff), rent, utilities, marketing, and administrative costs. Input this into the “Operating Expenses” field.

- **Input Interest and Taxes (for Net Profit Margin):** For the most comprehensive view (Net Profit Margin), enter your **Interest Expenses** (cost of borrowing) and **Taxes**. These are usually the final deductions from your operating profit.

- **Click “Calculate”:** Once all relevant fields are populated, click the “Calculate” button. Our **Profit Margin Calculator** will instantly process the numbers.

- **Review Your Results:** The calculator will display:

- **Gross Profit:** Your revenue minus COGS.

- **Gross Profit Margin (%):** The percentage of revenue left after COGS.

- **Operating Profit:** Your gross profit minus operating expenses.

- **Operating Profit Margin (%):** The percentage of revenue left after operating expenses.

- **Net Profit:** Your operating profit minus interest and taxes.

- **Net Profit Margin (%):** The final percentage of revenue that’s pure profit.

- **Interpret and Strategize:** Use these insights to understand your financial performance. A low gross margin might indicate issues with production costs or pricing. A low operating margin could point to high overheads. The net margin gives you the ultimate picture of overall profitability. Adjust your pricing, costs, or operations as needed based on these insights.

Regularly using this **Profit Margin Calculator** empowers you to keep a finger on the pulse of your financial health, ensuring smarter decisions for sustainable growth.

Ready to boost your business’s profitability?

Start Calculating Your Profit Margins Now!